I believe we will see the culmination of the secular bull market (2013 – 2029/30) with AI stocks peaking, potentially forming a bubble at the end.

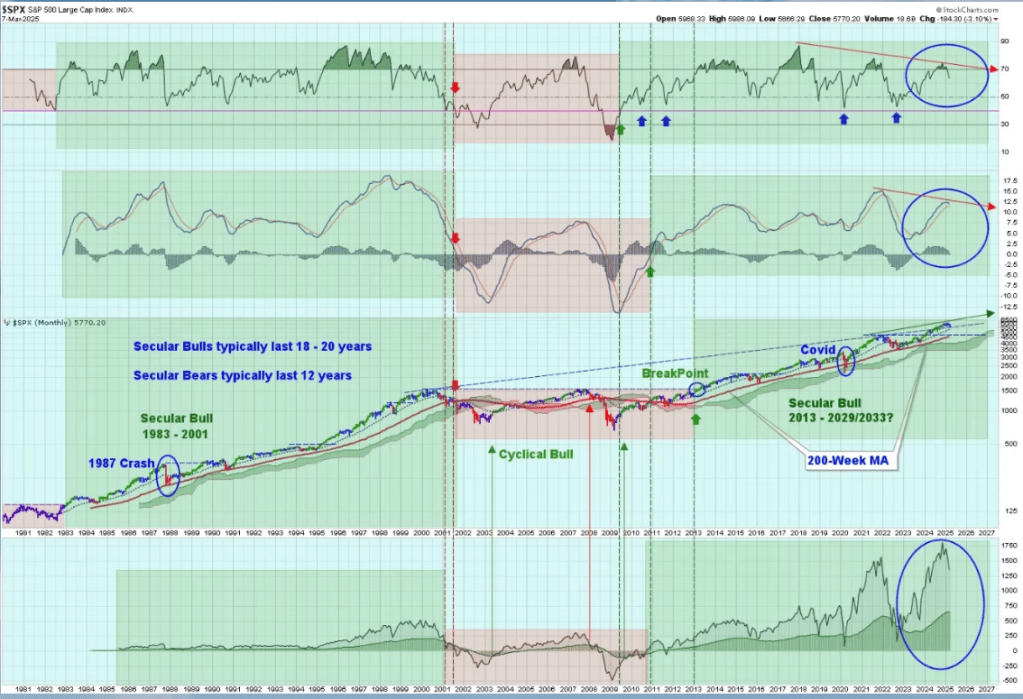

Secular Bull and Bear markets:

Source: Breakpointtrading.net

Concept of secular bull and bear markets, as I understand it, is that the index never closes below the 200-week moving average in a secular bull market, while exhibiting choppy behavior during secular bear markets. Though purely a chart observation, this concept makes intuitive sense to me. We have seen in a micro setting that a stock’s price and fundamentals do not always align due to herd behavior and psychology, as stock prices often overshoot while discounting many years into the future. Consequently, those stocks may display long periods of sideways, choppy behavior despite underlying growth, before eventually reclaiming previous highs where fundamentals catch up to price. A recent example of this is Amazon, which experienced this phenomenon where price and fundamentals took time to align.

Bubbles:

Bubbles are a sign of economic prosperity enabled by new technology for mankind. For a bubble to form, we need excess liquidity and economic prosperity.

We need some economic exuberance similar to the period between 1996 and 1999, when U.S. productivity growth was above 2.5%. In 1994/95, one of Fidelity’s portfolio managers thought the market was expensive and sat out the whole bull market, but it never fell due to the growth of the economy. In 2020, a lot of money was given as stimulus, which created surplus cash in the hands of people, leading to a mini-bubble scenario in 2021.

I am hopeful that some reduction in the U.S. budget deficit will bring the U.S. 10-year yield down, and we need to unlock productivity growth with AI in 2026, 2027, and 2028. Perhaps that will culminate in euphoria in 2029/2030.

Some excerpts from Internet on 1980’s, 1990’s

• 1990s: Labor productivity in the nonfarm business sector grew at an average annual rate of 1.4%. This period was marked by slower technological advancements and less efficient production processes compared to later decades.

• 1990s: Productivity growth increased to an average of 1.9% annually, a half-percentage-point improvement over the 1980s. The late 1990s saw even faster growth, averaging 2.5% per year from 1995–2000, driven by advancements in information technology, stronger capital investment, and corporate restructuring.

The fact that we had the frothy behavior of 2020-21, followed by stocks falling 90-95%, is significant. However, many of the stocks that dropped 90% did recover, especially those with good business models in SaaS or marketplaces. To drive home this point, let me give an example of CrowdStrike: When I looked at this stock in early 2020, it seemed quite expensive, while a regular retail participant was super excited by the hype and bought it. These stocks had incredible business models, and even though they were early in their growth phase, paying a higher price didn’t cause much damage. This reinforcing behavior will lead many retail participants to exhibit the same pattern of buying at any price toward the tail end of this bull market.

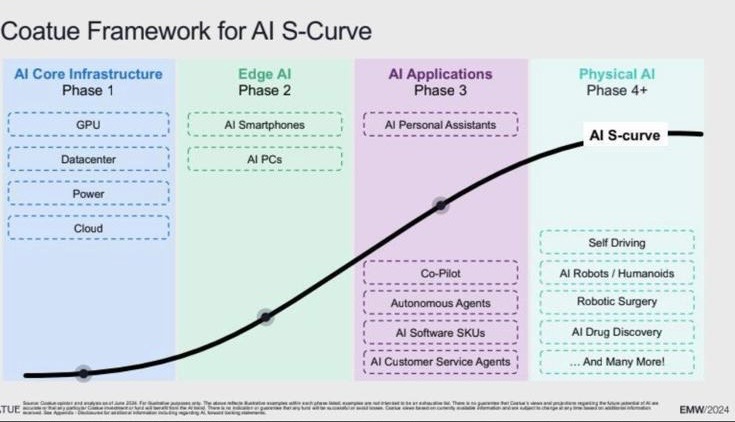

AI cycle:

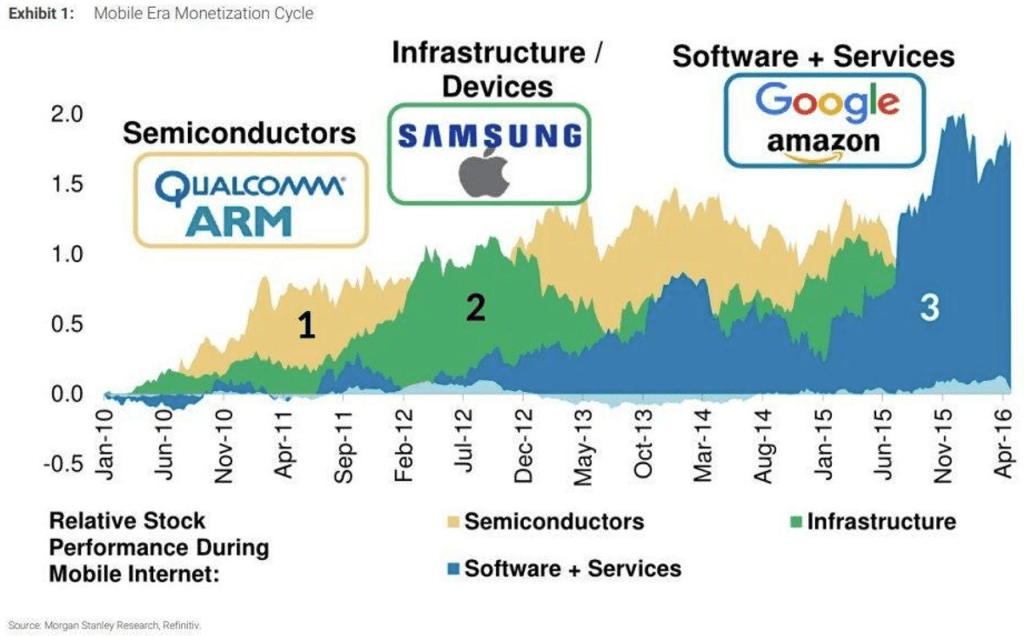

The chart below shows how stock leadership changed as the smartphone wave was playing out. Initially, it was hardware stocks, then infrastructure, and finally the application layer. I have a theory on why it played out this way. Wall Street loves accelerating revenues and margins, especially when there is surprise upside, creating huge short- to medium-term price movements. As the smartphone wave unraveled, accelerating revenues started to appear in that sequence.

Now trying to guess how things might play out in the AI wave. Clearly through 2023/24 notable winners are Nvidia, Hyperscalers, Power stocks and few other datacenters build out related stocks.

Assuming above pattern matching works. Below are obvious winners:

– 2025-26: Apple/Samsung, HP/Dell

– 2027-28: CRM, ServiceNow

– 2029-30: Tesla/Waymo

I was looking through 2023, 2024 for big winners around AI theme to back test a little. Here is what I observe:

– 2023: Nvidia – 233%, Vertiv – 246%, SMCI – 242%, Meta – 194%, SMIC – 246%

– 2024: Palantir – 340%, Vistra Corp – 261%, Nvidia – 171%, Applovin – 268%, Meta 70%, SMCI – 66%

You can notice there are application layer companies like Meta, Applovin doing very well as they already had existing businesses at app layer which were able to leverage AI power quite early.

I am trying to position myself for the climax of this bull market coinciding with AI bubble taking up stocks multifold.

Finally a prediction: I heard someone say during Dotcom bull market leadership switched from Cisco to Microsoft as bull market progressed. I believe Nvidia is the Cisco and Tesla is the Microsoft of AI bull