I have been investing in markets pretty seriously with serious amount of money since 2018, it is a good time to sit back and reflect on my investing process/edge. My portfolio has been down 70%-80% twice (not during Covid as I was in lot of cash by chance) and both the times I made all the money back. Also, I missed the biggest bull market of Covid which needs a separate post by itself.

One of my friend was asking do I use Macro, Technicals or just fundamentals. How much cash do I keep?

I believe for the most part my edge comes from understanding fundamentals of a company and buying at a reasonable price compared to its Terminal value. (This doesn’t mean I buy companies with high PE or low PE but instead where I believe the current market cap is lower than where it can get to). How I evaluate a sector or company is a post by itself for future.

Once in a while I do get attracted/inclined to management when they have some peculiarities that make me believe they are independent minded where I make management bet.

Regarding questions like How many stocks do I have in my portfolio, How much cash do I hold, Do I buy and hold for ever like Warren Buffett. Here are my thoughts while still evolving

- My inclination is always to be fully invested unless I am short of ideas

- I aspire to have 3-8 stocks in my portfolio depending on how many ideas, conviction and the relative opportunity set across stocks. I do have tendencies like buy tracking positions, buying a small amount about new exciting idea, hence constantly fighting to trim the count.

- If I believe the runway of an individual company is really long with tailwinds, might tactically buy/sell a portion of position but for most part will hold irrespective of macro. In this situation the fundamentals of the company short, medium and long term look bright. Statistically the probability of me finding an idea like this is more like 1 in 5 years.

- Primarily I buy stocks which have the potential to 3x in 5 years and secondarily buy some stocks for a bounce which are more like placeholder trades when I have cash in portfolio.

- I don’t benchmark against index or other fund managers. My goal is to make multiples of my capital and worst case 8% per year. Broadly what I am saying is I want to 100x my money in 15-20 years without blowing up my account. 3x in 5 years will narrow my focus on right opportunities while worst case 8% reminds me not to buy unproven business models or overvaluation or leverage to blow up my account.

- Hunting grounds for 3x in 5 years

- Growth companies with runway

- Beaten down cyclical or Turnaround in high quality company

- 5-10% Growth + <10 PE for high quality + Buy backs (e.g. 2018 Apple stock)

- What to avoid:

- Buying into a company without following for 2-3 quarters

- Buying low quality companies when market is hot

- Deploying instead of raising cash in late part of bull market when frenzy is quite obvious (2021)

- Going heavy and crazy into unproven business models (I have a dime a dozen failures under my belt)

- Buying options unless stock has been basing or I am super confident while it is really beaten down

- Going big with new instruments (e.g. SPACs in 2021)

- Taking anyone’s opinion unless I have followed them and known their style for some time even if they are well known investor

- Portfolio construction: Loosely 33%/33%/33% allocation across 3 stocks, but more importantly there is no trimming if allocation changes instead let the winners run

- Buying and Selling: Will explain this as a separate post as well

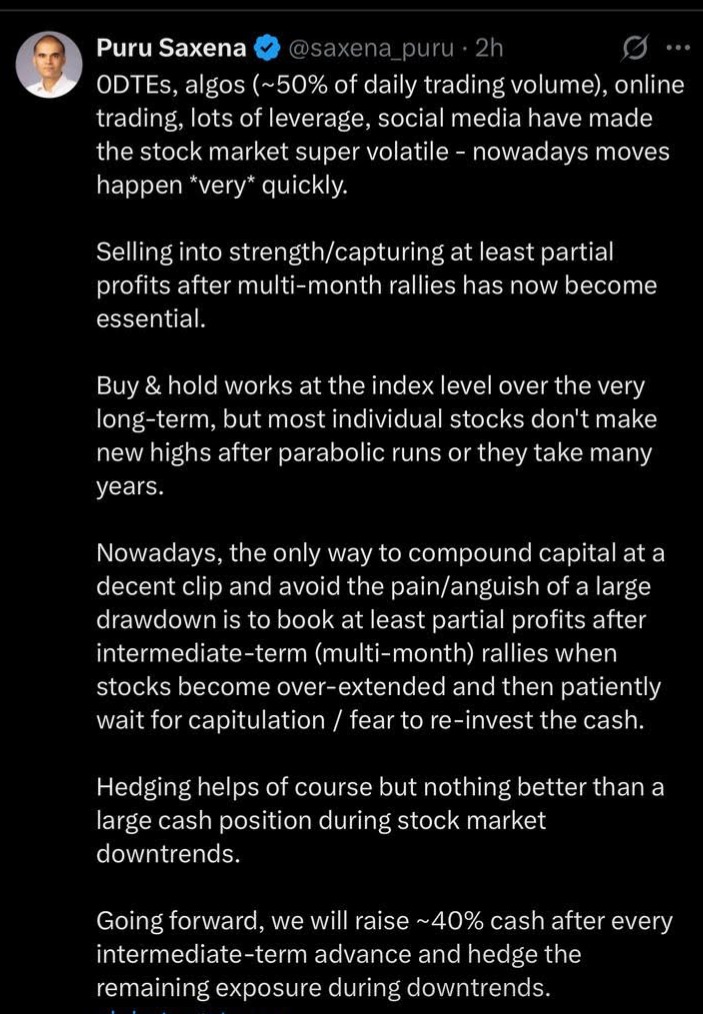

- More recently I am exploring the idea of raising cash at Portfolio level when broad valuations look elevated e.g. Dec 2024 S&P PE : 28 was around historical highs + Technicals show market momentum slowing down + Lurking Macro dangers (recently it was Tariffs and Refinancing of 30% of US treasuries). Only danger is we never know which bubble goes longer than anyone expects.

S&P PE 10-Year Average: About 18.96, with a range of 16.74 to 21.18.

S&P PE 20-Year Average: Around 16.24, with a range of 13.84 to 18.65

Below tweet from Puru needs a pause and reflect

- The way I raise cash is trimming the macro sensitive sectors/stocks first or stocks with elevated valuations

Fast vs Slow markets (Where I make money): Fast going up markets FOMO and Fast going down markets trying to catch bottom both never worked for me. I have tried both the emotions gets the better part of me. I made most of my money in the middle 80% of the market journey.

Few people I follow for reliable cues

- Macro – Brad Gertsner

- Technicals – Breakpoint trading

- Finding Bottoms – VIX and Basant

- Asymmetric Bets/Turning Points in market – Bill Ackman

I will do a follow up post to go deeper on

- How I weaved Technicals, Macro, Fundamentals, Feelers to decide raising cash at Portfolio level in Dec 2024

- How do I evaluate a stock or company

- How I missed the Covid bull market

- Behavior of Growth Vs Value stocks