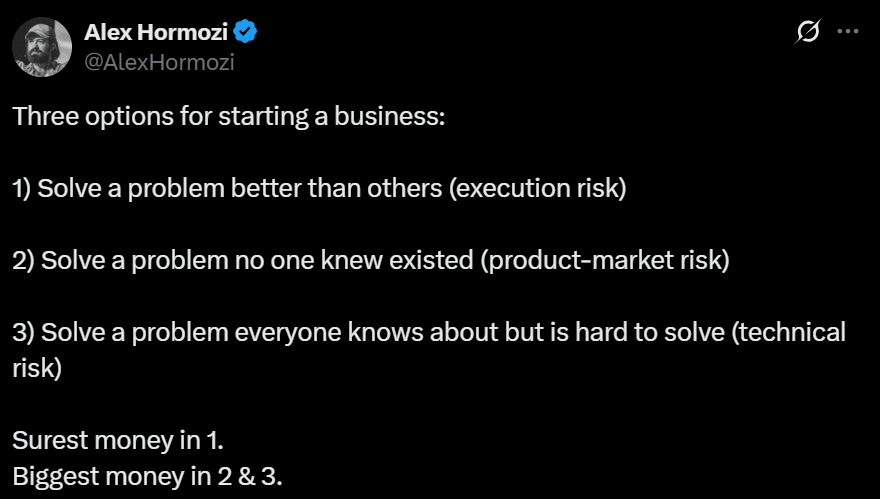

🏢 Private Equity = Operational Excellence

✔️ Solves known problems more efficiently

⚙️ Leverages process, scale, and execution

📉 Low risk, steady reward → Option 1

👥 Investor Types: Private Equity Funds, Growth Equity, Family Offices, Corporate Development

🚀 Venture Capital (95%) = New Problem Hunters

💡 Backs ideas the world didn’t know it needed

🎯 Risk = product-market fit & early adoption

📈 High upside, high failure → Option 2

👥 Investor Types: Early-stage VC, Seed Funds, Angel Investors, Accelerators

🌌 Venture Capital (5%) = Frontier Chasers

🧠 Tackles big, obvious, hard problems

🔬 Requires breakthroughs in tech, physics, policy

🌠 Rare, bold bets → Option 3 (Elon Musk zone)

👥 Investor Types: Deep Tech VC, Gov-aligned Capital, Billionaires, Mission-Driven LPs

💡 The Tech Wealth Explosion: 2010 vs 2025

- In 2010, only 2 tech companies — Apple and Microsoft — were in the Top 10 market cap list globally.

- In 2025, it’s flipped: now there are only 2 non-tech companies in the Top 10.

🚀 Software: The 10x Mega Tailwind

- The software market has 10x’d over the last 15 years.

- This is the megatrend that VCs, Bay Area founders, and employees have ridden — perhaps the strongest tailwind in modern economic history.

🌁 Bay Area vs Seattle: Wealth Surge (2010–>2025)

- Bay Area market cap:

From $250B → $10T - Seattle Area market cap:

From $300B → $5T

The wealth effect from this growth is staggering — a complete reshaping of local economies, housing, and talent flows.

🦄 VC Landscape: 2010 vs 2025

- In 2010, a $5B VC exit was nearly unheard of.

- Today, there are hundreds of unicorns, and $5B exits barely raise eyebrows.