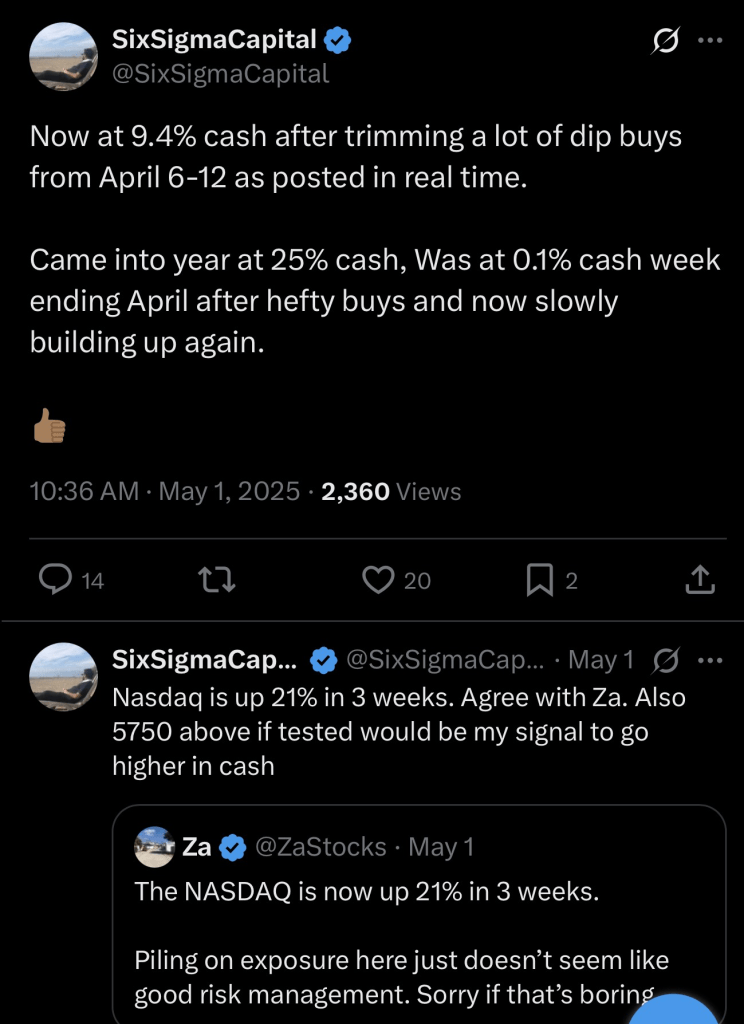

I did lots of flip flopping between April 1st and now by buying/selling. The above tweet shows how masterfully one can be with allocating capital during very high VIX days and slowly trimming. I am horrible at buying fear and mostly due to my greed to buy at even lower prices. One could have simply bought 3x QQQ during VIX above 50 days and made money hand over fist.

CLARITY & PRICES DON’T COME TOGETHER

This week’s big tech earnings have shown no slowdown in Cloud spend (which is a proxy for Fortune 500 enterprise spend) or much slowdown in Ad spend at Meta or Google (proxy for companies spending on ads to sell to consumers, if consumer is weak, they would pull back on this spend)

Reflecting on some mistakes:

- LEAPs in a stable mega cap in my portfolio were down 50% during April and up 50% after earnings reported. I could have easily doubled down on my position in this situation.

- Shallowly researched bets like Block which I bought late last year should have trimmed after 50% gains as it was shallowly researched and not core holding. Holding till now buying a cheap stock with low conviction got hit by fundamentals is further down in addition to Tarriff pullback

Technicals flipped to green while the macro concerns still linger:

Markets already rallying 20%+ from the bottoms and Bill Ackman calling for pause on China Tariffs make me wonder if market knows something that I don’t. Technicals show we made a higher low on the major indices and the market timing strategy I follow flipped to long term buy. I am torn between doing nothing vs deploying more cash to work.