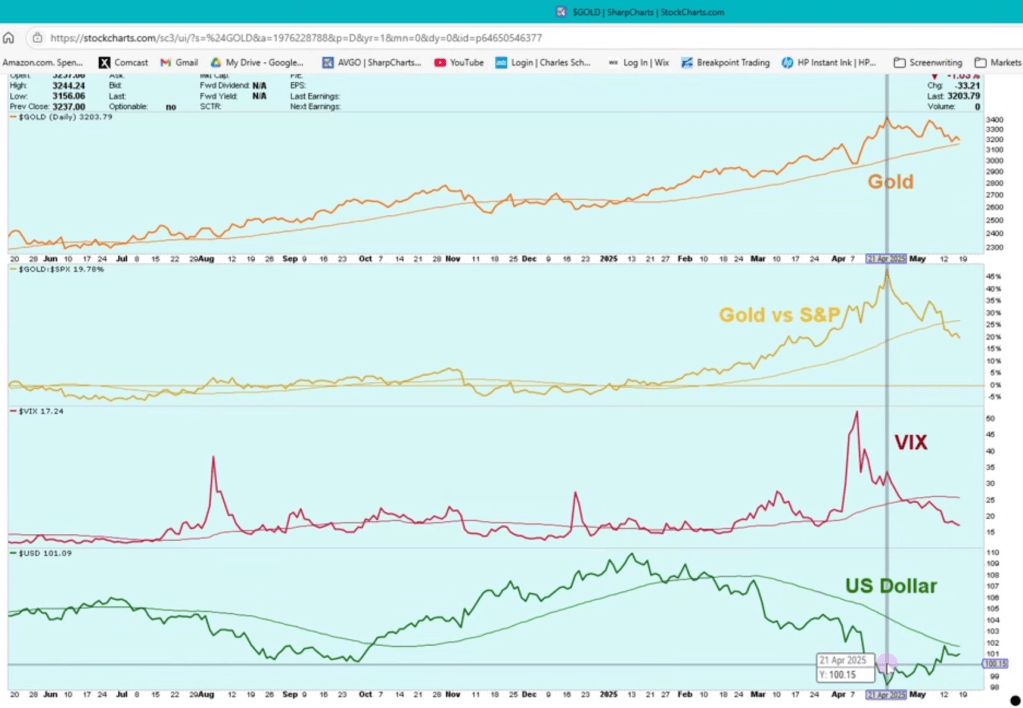

Gold vs Dollar chart: Interesting to see gold topping while the dollar hitting the lowest levels

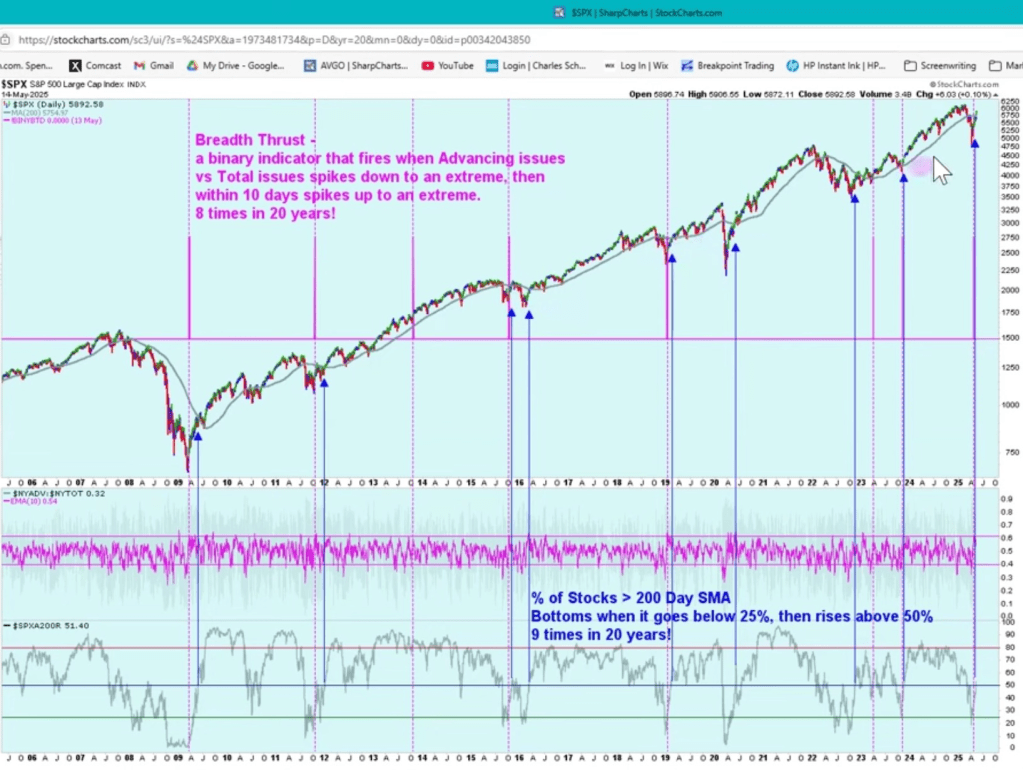

Breadth thrust chart: Lot of chatter in twitter around Breadth thrust.

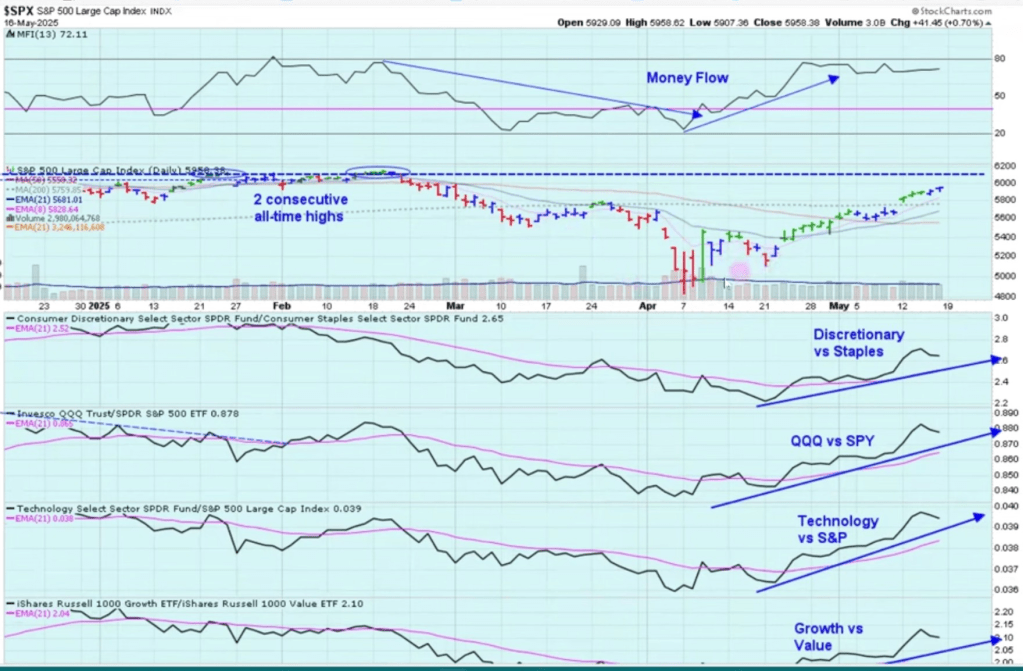

Risk on: WallStreet is clearly in risk-on mood with money flowing into growth

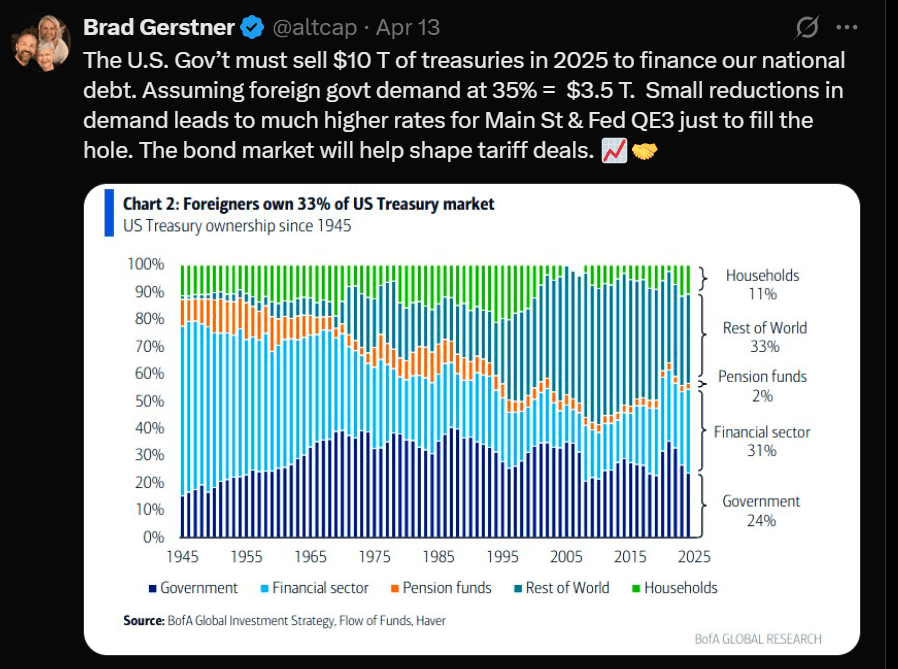

Catalyst in next 6 months are rate cuts and lower taxes. Deterrents are US need to refinance boatloads of Treasury notes maturing this year.

My view is Macro got better since week of April 21st, Technicals gave long term buy on May 2nd as S&P made higher lows. Looks like we have already traversed the recovery from bottom, next leg up will be driven by liquidity (due to rate cuts, tax cuts and QE in the back half of the year). Very likely stock market discounted a shallow recession, and we are off to the races

Just some random observations: Growth stocks have recovered in a stellar fashion. Consumer discretionary stocks like Carters, American Eagle etc haven’t recovered may be the Tariff overhang is still on them. On a side note, Dicks buying footlocker is such a shrewd move of buying assets when beaten down and sentiment is poor to play for recovery.