Things that caught my attention this week

- 20-Year Treasury open auction to raise $16B: Yields spiked due to a lack of demand—or maybe the market is pricing in growth due to tax cuts. It’s anyone’s guess.

- Japanese bond yields are spiking too. Time will tell, but it feels like a regime shift after 10–15 years of slow growth and low bond yields. Investors are demanding higher yields on bonds across the world. (Below are messages I exchanged with a friend when I first saw this.)

- Tax cuts bill passed through the House, and the initial contours show a further increase in U.S. debt. This clearly shows Congress is not yet worried about the U.S. debt problem. Experts say that eventually, the bond market will have to force our hand to get consensus among elected officials for spending cuts. I have blind trust in Scott Bessent (coming from a wealth of experience working with legendary macro investors like Stanley Druckenmiller in his past career) to help us navigate the bond market, at least for the next 3–4 years

- Elon Musk admitting the difficulty in pushing through DOGE reminded me of Stanley Druckenmiller’s comments earlier this year, saying he’s old and skeptical.

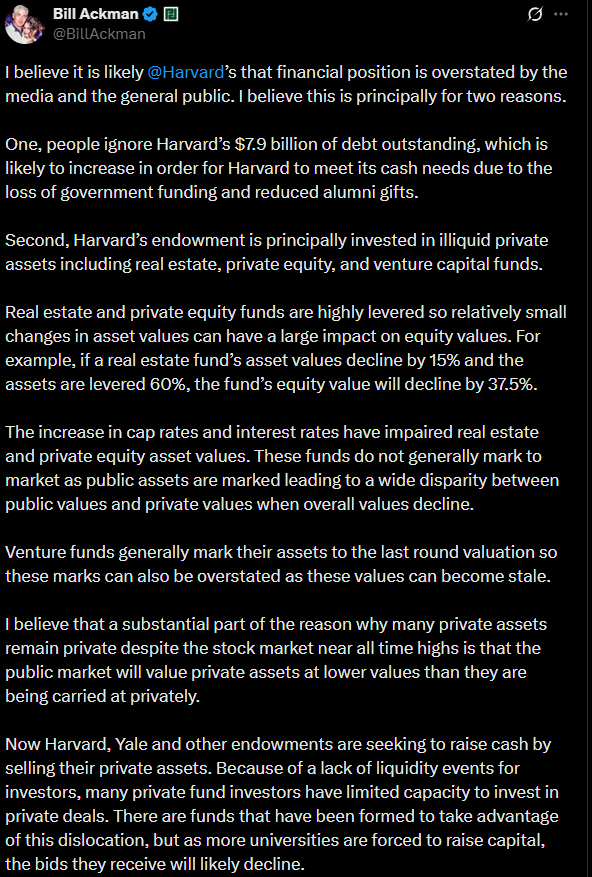

- Bill Ackman’s comment around PE, real estate, and venture portfolios being marked pre-2021 means they are not reflecting the new interest rate regime. Most endowments and family offices are already fully allocated to these asset classes, which means future prices may go down or stay flat.

The only optimistic path I can envision for the U.S. to get out of the debt problem is through growing GDP and productivity. I’m going to closely track Scott Bessent’s “three-legged stool” (tariffs, taxes, and deregulation) and his eventual goal of hitting a 3-handle on the budget deficit by 2028.

As I talk with friends, most of them are bearish about stocks and the general economy. I, however, am extremely bullish starting in the second half of this year. The trifecta of tax cuts, some reduction in Fed rates, and QE (it looks almost certain the Fed will have to buy Treasuries to fund the U.S. deficit this year) will create massive liquidity in markets and be largely stimulative for the economy.

My thesis is that this will bring back confidence on both Wall Street and Main Street. We’ll start seeing the benefits (or at least the perception) of AI, which could unleash animal spirits in both arenas. I expect the market to run hot between 2026 and 2029.

However, I expect the period after 2029 to be very difficult—potentially 10–15 years of flat index performance. That expectation comes from connecting dots around the U.S. debt problem, mark-to-market issues in private equity, real estate, and venture capital, and the prevailing trend of ETFs/indexing—especially if we reach a euphoric top in 2029 driven by an AI bull market. (The deeper reasons for this outlook are best suited for a private phone conversation.)

Coming Age of Wealth Divide

We’re likely heading into a period of massive wealth divide, driven by inflation and AI over the next 10–15 years. A 30-year fixed-rate mortgage obtained during the low-rate era will likely prove to be one of the best assets adjusted for risk.

Bitcoin and gold, as inflation hedges, should perform well. Hypergrowth AI companies should also thrive—at least for the next 5 years.

That said, these are not blind bets. We will need to navigate market cycles and liquidity dynamics across asset classes carefully.