Angel Investing segment of the market is in the biggest bubble not the stock market. Founder raising angel funds don’t know what Product Market Fit Vs Product Master Fit.

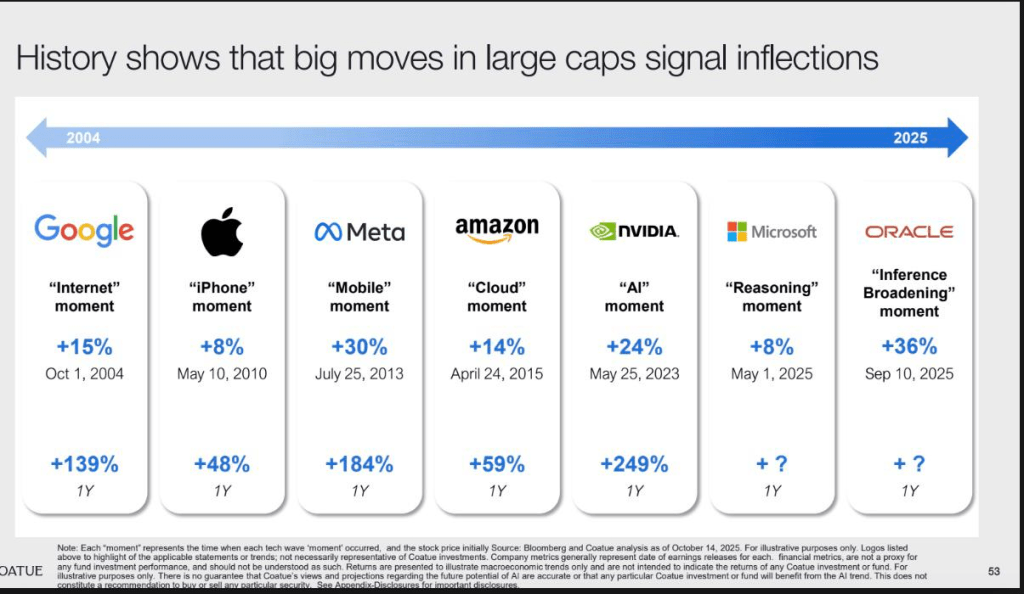

I suspected O series models from OpenAI in Dec 2024 was a game changer, haven’t really thought much about Oracle’s stock price move. Need to be on the watch out for AI application explosion next year.

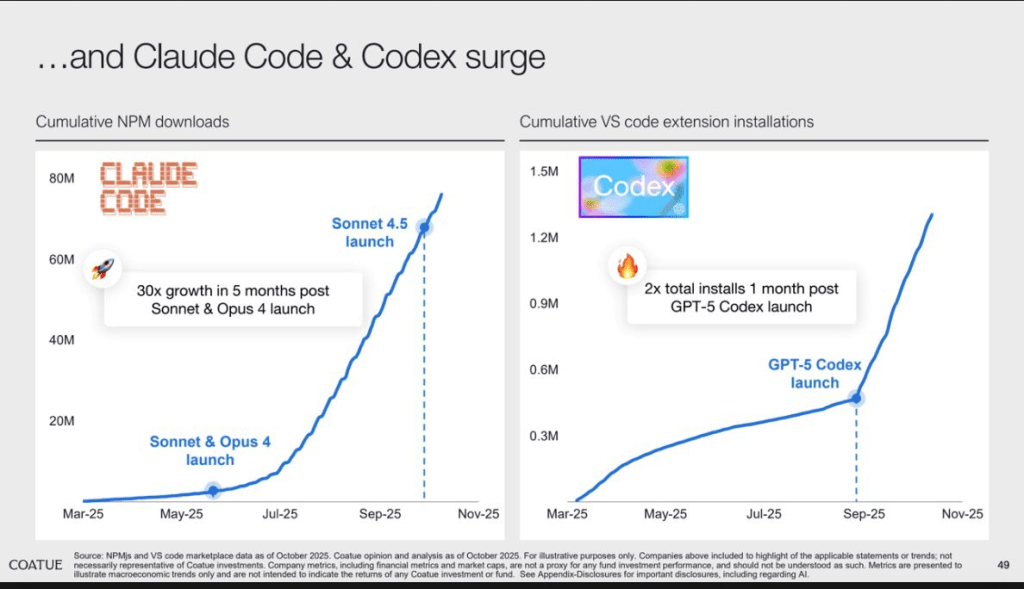

Exponential growth in the coding category of AI usecases.

I heard in some podcast that healthcare AI companies are unique in the sense that if there are 5 players all of them are winning. It is mind boggling my theory is the earlier digital waves Internet, Mobile, Cloud haven’t seen big winners in healthcare sector which signals lot of low hanging fruit and may be the usecases needed AI for productivity gains.

Zuck knows even if there is slightest chance that Ad model gets disrupted the Meta, Instagram business is at huge risk. It fully makes rational sense to aggressively protect and recruit talent. Wonder how this phenomenon will impact Applovin. If the Ad inventory shrinks then existing Ad inventory becomes extremely more valuable, there is a scenario where Applovin can become $1T company assuming the mobile games still are relevant and the inventory doesn’t shrink.

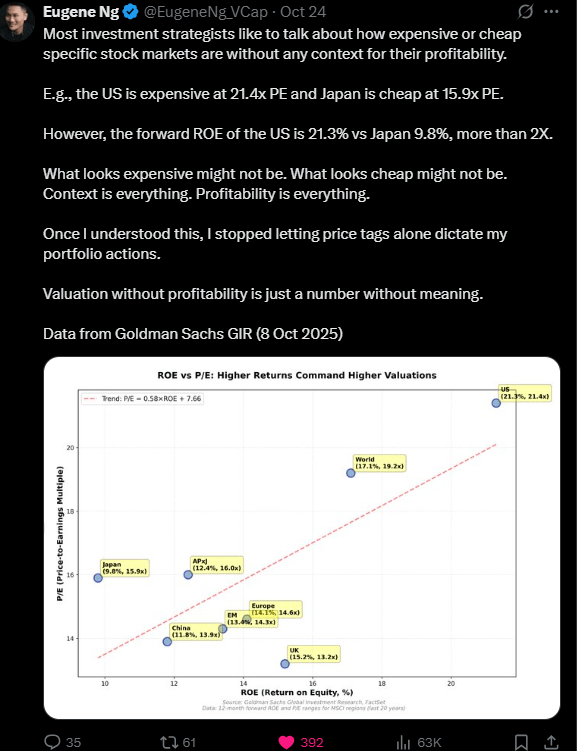

Great tweet contextualizing PE. PE is not merely an indicator of earnings growth but also quality of company which is indirectly reflected through ROE, margins etc.

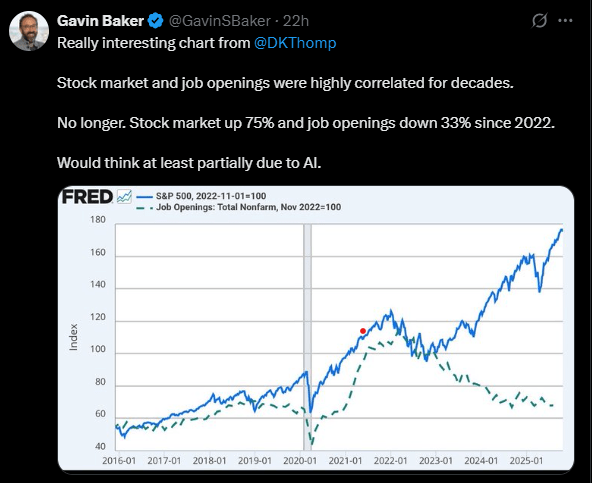

I am suspicious this is not a new phenomenon instead we were coming out of bear market from 2022 mostly driven by big tech, who were doing all the cost cutting to fund their capex. After the rate cuts from no on through next year we will start to see job market rebound strongly while the stock market goes up as well with the rate cuts cycle.